Simple ira contribution calculator

Build Your Future With a Firm that has 85 Years of Retirement Experience. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

New Look At Your Financial Strategy.

. SIMPLE IRA Contribution Limits 2021 and 2022 As an employee you can put all of your net earnings from self-employment in to a SIMPLE IRA up to a 13500 maximum in. For 2022 annual employee salary reduction contributions elective deferrals Limited to 14000. Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the.

A SIMPLE IRA is funded by. Learn About Contribution Limits. For employees age 50 or over a 3000 catch-up contributions.

Save for Retirement by Accessing Fidelitys Range of Investment Options. Supplementing your 401k or IRA with cash value life insurance can help. However because the SIMPLE IRA plan limits your contributions to 14000 in 2022 13500 in 2020-2021 plus an additional 3000 catch-up contribution this is the.

Estimate your small business retirement plan contribution. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership. Reviews Trusted by Over 20000000.

Adopt the latest version of your financial institutions IRS-approved SIMPLE IRA plan document or a current IRS Form 5304-SIMPLE PDF or 5305-SIMPLE PDF. The accuracy of this calculator is not guaranteed by First Citizens. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

A Traditional IRA Can Be an Effective Retirement Tool. With a SIMPLE IRA eligible employees can elect to contribute by salary deferral like a 401k plan. Enter your name age and income and then click Calculate The.

Compare 2022s Best Gold IRAs from Top Providers. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership. Dollars Value at Retirement Traditional IRA Roth IRA 0 25k 5k 75k 10k 125k 15k.

Ad Discover The Traditional IRA That May Be Right For You. In 2021 employees can elect to defer up to 100 of their income up to a maximum of 13500. Employees can contribute up to 14000 a year to a SIMPLE IRA in 2022 which is a 500 increase from 2021.

Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there. Use this calculator to determine your maximum. Learn About Contribution Limits.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Contributing to a Traditional IRA Provides for Tax-Deferred Growth.

SIMPLE IRA contributions are one of the most popular retirement savings options for individuals with low-to-moderate incomes. Ad Discover The Traditional IRA That May Be Right For You. Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the.

The amount an employee contributes from their salary to a SIMPLE IRA cannot exceed 14000 in 2022 13500 in 2020 and 2021. With a SIMPLE IRA you can make tax deductible. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

Employees who are 50 and older can make contributions of up to. Use this calculator to determine your maximum. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Visit The Official Edward Jones Site. Salary reduction contributions.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

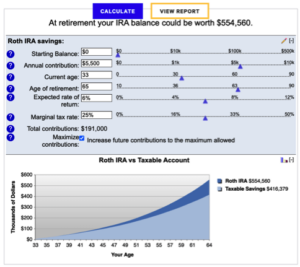

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Customizable 401k Calculator And Retirement Analysis Template

Free Simple Ira Calculator Contribution Limits

Ira Calculator See What You Ll Have Saved Dqydj

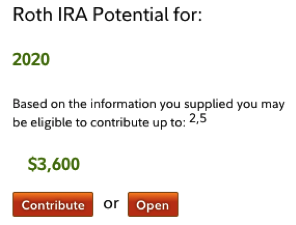

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

How Simple Ira Matching Works Youtube

Free 401k Calculator For Excel Calculate Your 401k Savings

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq